Most people derive Tax season as a daunting docket, which it does not have to be. Every year millions of people plunge into the complex ocean of tax returns with different level of confidence and knowledge. If you’re a regular filer and certainly if this is your first time to file a tax return, it is about time that you learn that there are obstacles or risks that are always likely to arise on the process. Although doing one’s taxes is an important responsibility, it also offers specific areas of chance for maximizing tax reductions and minimizing anticipation. However, there are usually some mistakes than most people do that makes what is supposed to be an easy process a nightmare. Now some mistakes that you would wish to avoid while filing your taxes this year include the following.

Benefits of Lodging a Tax Return

Filing a tax return has a number of benefits that can make a huge difference to your financial situation.

But, it enables you to claim any refunds you are due by law. Unfortunately, most taxpayers fail to fully seize this chance to save their money. Filing assures you for you get what you are legally entitled to receive.

Second, through submitting your return, record keeping with the authority is kept well updated. This is advantageous in situations where for instance an audit arises or an inquiry about prior filing.

Also, filing your taxes can create a foundation for future items like loans or mortgages to be approved. Employers need evidence of income and responsibility; a filed tax return helps to show this.

Filing of a tax return enables an individual or organization to agreed with the legal requirements of law. It also helps to avoid specific penalties, fines in the further in case of exceeding the permitted limits. All these are important because every financial benefit brings about positive result in handling finances and reduces worry.

Common Mistakes Made When Filing a Tax Return

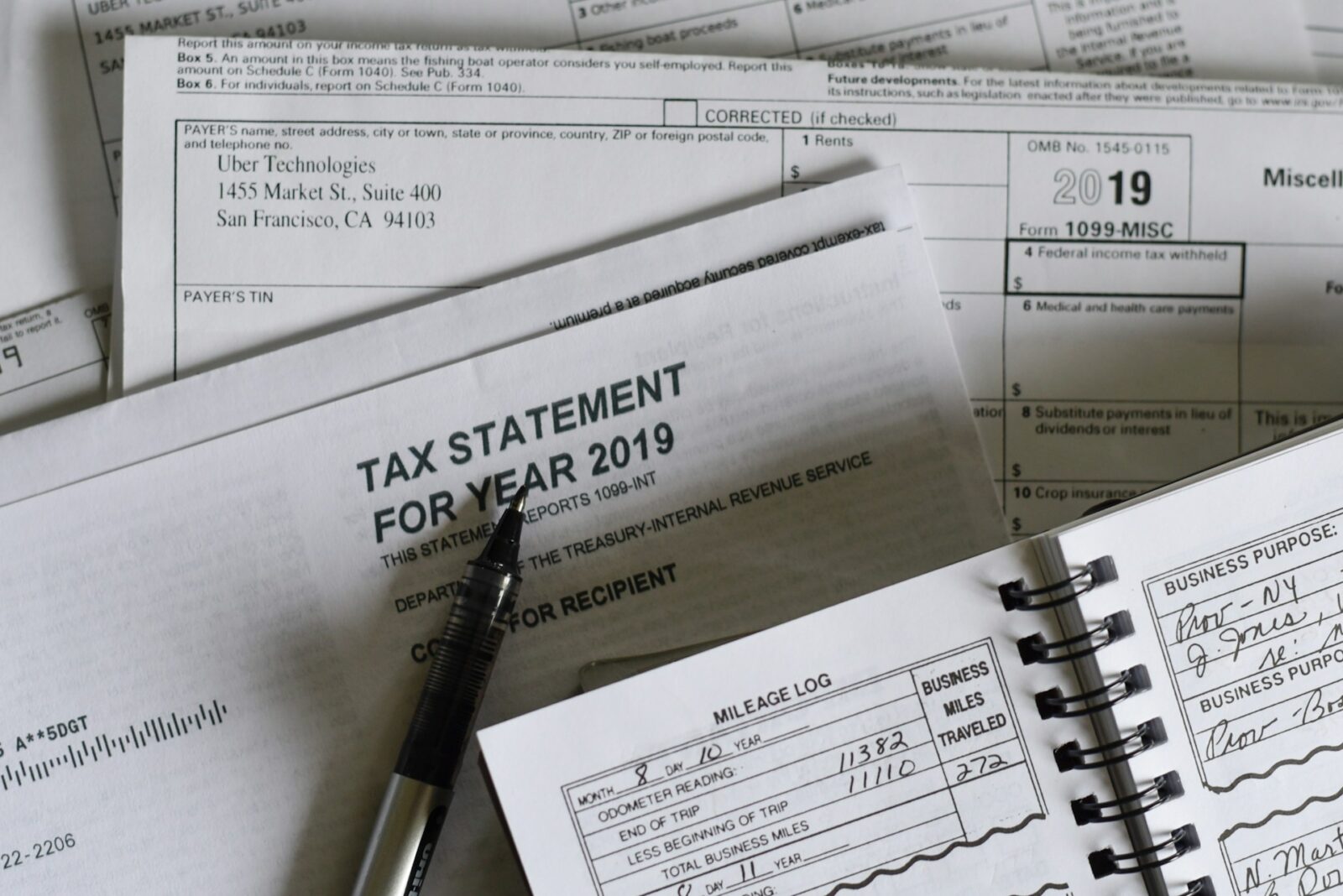

lodge your tax return is not easy and can be stressing; there are some common mistakes. One blunder is failure to make record of incomes and expenses during the course of the year. When it comes to the time of filing, missing documents leads to wrong and misleading records.

Another common mistake comprises taking the wrong deductions, or amending them to wrong figures. A lot of folks estimate eligible claims incorrectly or don’t spend enough time to discover what they are allowed to deduct — and pocket the change.

However, ignorance of the tax laws and the requirements are usually causes of cumbersome situations. Basically, taxes laws are prone to be altered from time to time, therefore it is important that the correct filings be made in line with these changes.

Every one of these missteps is capable of posing stress, and possible financial consequences. This means when you are preparing your tax returns, you not only get the largest possible refund, you also maintain a high level of compliance to legal requirements.

Neglecting to Keep Track of Income and Expenses

The major element that is most often overlooked when preparing for filing a tax return is the aspect of income and expenditures. Most people think they can remember what they earned or their business expenses which is always a mess.

Failure to organize records means that some people may not see certain deductions that may actually save them money. You are likely to spend more than you should due to lack of documenting your operations throughout the year.

Varied record keeping can also give stress when deadlines are nearby. It is always unwise to start searching for information this close to the deadline; things are missed, and errors are made.

Tracking in apps or in a spreadsheet provide a completely different experience. Not only can it make the tax season much easier but also keep you informed about your situation financially throughout the year. Documenting everything means there are not many shocks that come with tax filing time, specifically April 15th.

Incorrectly Claiming Deductions

It is not easy to claim deductions at the best of times. As it is, many taxpayers fail to claim what they genuinely ought to, mainly because they are not well-versed with what constitutes a legal write-off. While some employees will be very prudent in their expenses, there are others who will spend exorbitantly and try to recover money that doesn’t qualifies for an allowance base on the Internal Revenue Service.

For example, it is not advisable to build up personal expenses and present them as business expenses. The need to distinguish between what may be considered as actually allowable and what cannot.

It is important to document their affairs when claiming any deduction is taken. If these records are not kept properly, you will realize you need the records to deal with audits or penalties at some point in the future. Also, it is recommended always to save receipts and notes associated with your claims.

Another common mistake people make is file categorization – for example, confusing depreciation categories such as travel expenses or not following strict limits on home office expenses. This may lead to what I call the double counting and overestimation of amount eligible for a particular loan.

Of course, knowing these issues will help you avoid risking one’s own financial interests while at the same time abiding to the principles of taxation.

Not Understanding Tax Laws and Requirements

Yearly taxes can be quite complicated and can indeed change from year to year. It is usual for a number of people think that they know everything about compliance when actually there can be some issues they are not aware of. Such ignorance results in plenty of mistakes that are made on the tax returns as well.

Tax laws are always changing and it is wise to ensure that one is undertakes to update herself or himself with these current laws according to the economical earning and personal details. Lack of knowledge in this case would lead to losses for failure to gain from new provisions or compliance penalties.

It is advisable to see a tax expert if you have any doubt whatsoever about preparing and submitting your return. They can offer you advices suitable to your personal case, guide you through the confusing system of tax legislation. This means that, as much as it helps your business adhere to the law, you are seizing every credit or deduction you rightly deserve.

It seems to be self-explanatory because knowing your rights assist you when making your payments, thus you should make it a point of trying to learn more about any changes made in that year. This way you will be in a position to file without fear – failure to do so is always due to ignorance of what is expected from you.